IMTFI Syntheses

(view full list on eScholarship)

Mobile Money: The First Decade

This white paper surveys the lessons from the first decade of research into mobile money, focusing on an archive of studies produced by IMTFI Fellows. The paper describes mobile money's primary use case—P2P money transfer—and argues that both the "Ps" and the "2s" of this model (mobile money's "peers" and the technological and social infrastructures that intermediate them) must be understood in context. The paper then outlines ten insights from the IMTFI research archive that demonstrate the contextual complexities involved in introducing and scaling mobile money, including discussions of: agent networks; physical infrastructure; location, place, and space; kinship and family; gender and gender inequality; class, caste, and rank; religion and ritual; time and tempo; government and regulation; and the persistence of both cash and non-currency stores of value. The paper concludes by raising issues that promise to be critical provocations for the next decade of mobile money research, making an argument for methodological diversity, and interrogating the limitations of the "financial inclusion" frame within which mobile money has been situated as a development intervention.

Mapping the intermediate: lived technologies of money and value (Introduction) - 2020

TAs financial transactions are increasingly digitized, old and new kinds of intermediaries are only expanding in importance. Intermediaries, mediators and brokers sit at critical junctures and operate between diverse financial arenas and pathways. We argue that mapping the intermediate entails identifying how different kinds of actors—human and non-human, objects and interfaces, institutions and practices—delimit or reify but also stitch together and overcome spatial and temporal differences in people's financial lives, while taking on varying burdens of risk. Mapping the intermediate is both an empirical and methodological exercise. Empirically, it requires following the agents and traders, brokers and material objects that facilitate transactions and add, extract, or re-work different kinds of value. Methodologically, intermediaries and the intermediate are not only the objects of analysis but act as analytical tools in their own right, making the process and politics of transactions visible and tangible. Attending to the intermediate in our inquiries around money, currency and new digital financial technologies, thereby, offers new directions for grounding finance in politics and history and better connecting micro and macro and local and global economic processes.

Virtually Irreplaceable: Cash as Public Infrastructure (2019)

This white paper for Cash Matters takes a close look at the role of cash in society and the specific characteristics making it a public good, citing relevant studies, scholars and field experiments. "Cash in circulation is growing on a global scale by approximately 3% per year; 80% of all payments worldwide are cash transactions. Cash is an essential part of every stable financial and economic system", stated ICA Chairman Wolfram Seidemann. "This paper demonstrates that cash is more than just a means of payment. It is a public good, part of modern life and vital for people's everyday lives."

Introduction: Money and Finance at the Margins (2019)

Mobile money, e-commerce, cash cards, retail credit cards, and more—as new monetary technologies become increasingly available, the global South has cautiously embraced these mediums as a potential solution to the issue of financial inclusion. How, if at all, do new forms of dematerialized money impact people’s everyday financial lives? In what way do technologies interact with financial repertoires and other socio-cultural institutions? How do these technologies of financial inclusion shape the global politics and geographies of difference and inequality? These questions are at the heart of Money at the Margins, a groundbreaking exploration of the uses and socio-cultural impact of new forms of money and financial services.

Keeping Cash: Assessing the Arguments about Cash and Crime (2017)

This white paper for Cash Matters, an International Currency Association (ICA) movement, assesses the current literature on cash, cash usage, crime, and terrorism. Drawing from the IMTFI's accumulated expertise on monetary ecologies - from cash to digital - it examines a range of institutional, legal, scholarly, policy, news, media and other sources to understand the current state of debate about - and evidence for - the links between cash, crime, and terrorism

Trust and Money: It's Complicated (2016)

This synthesis features IMTFI projects in Nigeria, Kenya, Ghana, India, Mexico and the Philippines, exploring the theme of trust across four broad categories –Channels, Intermediaries, Accounting, and the Source. One of the key takeaways is that trust in new money technology grows when it can be one among many reliable channels for storing and transferring value.

The Mobile Money Experience in Sub-Saharan Africa: Lessons from the Institute for Money, Technology & Financial Inclusion (IMTFI) - 2016

The article is part of the January 2016 issue on "The Poverty of Development Strategy in Africa" and provides a comprehensive look into IMTFI's research findings in Sub-Saharan African from 2009-2104. "Think back to 2008: the first iPhone had just been released. M-Pesa, Safaricom’s mobile transfer service, was just beginning to hit the Kenyan countryside. The extent of the global financial crisis was becoming known. At the University of California, Irvine, south of Los Angeles, researchers had just begun thinking about the collision between mobiles and money. Founded that same year, the Institute for Money, Technology and Financial Inclusion (IMTFI) was in the process of supporting its first set of research projects, in countries ranging from Nigeria to Indonesia. When it funded its first cohort of 17 researchers from around the world in 2009, only a handful were exploring the expansion of mobile money technology. Three of the projects were in sub-Saharan Africa–in Kenya, Botswana and Nigeria. The other projects focused largely on alternative currencies, informal savings practices, programs. Five years later, in 2014, almost all of IMTFI projects involved research on mobile money, and 50% were being conducted in countries in Africa."

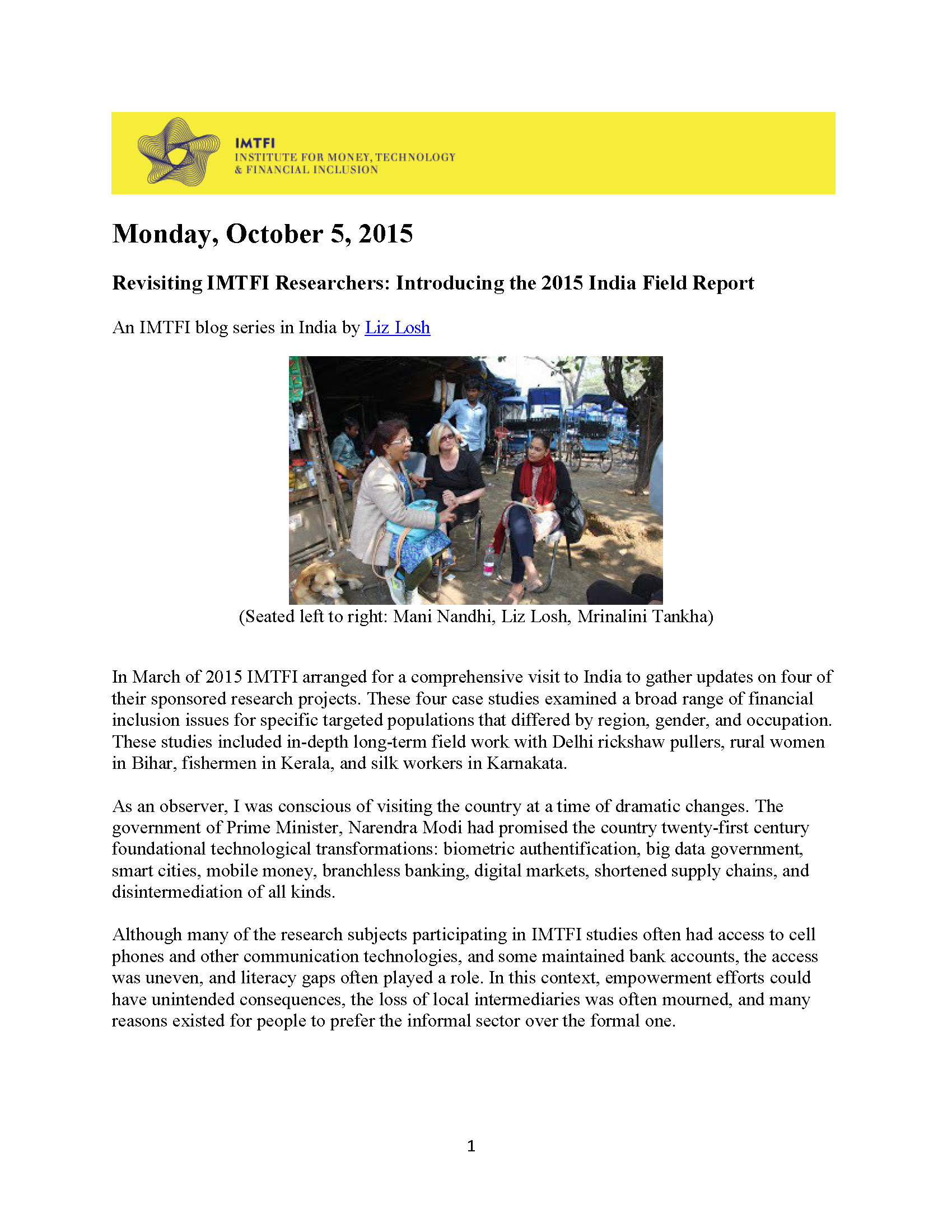

Revisiting IMTFI Researchers: Introducing the 2015 India Field Report

In March of 2015 IMTFI arranged for a comprehensive visit to India to gather updates on four sponsored research projects with the following fellows and researchers: Mani Nandhi, Deepti KC, Nithya Joseph and Janaki Srinivasan. This synthesis brings together the series—7 blogposts (10/2/2015-10/21/2015) featuring the four case studies examining a broad range of financial inclusion issues for specific targeted populations that differed by region, gender, and occupation. These studies included in-depth long-term field work with Delhi rickshaw pullers, rural women in Bihar, fishermen in Kerala, and silk workers in Karnakata.

Snapshots of Gender and Financial Inclusion (2014)

This document highlights themes found across 18 IMTFI projects of how women interact with different forms of money in a shifting global financial landscape. Based on research Philippines, Kenya, Paraguay, Nigeria, Mexico and India, these snapshots address the way gender relations get reworked when money circulates through digital technologies and is regulated by new financial institutions.

Warning Signs and Ways Forward (2013)

Emphasizing that there is no one-size-fits-all proposition, IMTFI researchers identify cross-cutting issues affecting client uptake for mobile and other electronic payment platforms.

Monetary Ecologies and Repertoires: Research from the Institute for Money, Technology & Financial Inclusion. First Annual Report & Design Principles (January 2010)

This report discusses IMTFI’s research in 2008-09 and includes Appendix: 11 Design Principles for Financial Services for the Poor. Based on academic, industry and policy findings from IMTFI researchers, these design principles provoke new kinds of inquiry and practice and offer checks and balances for designing and implementing savings services for the poor. Appendix 11 Design Principles: 1) Design for social obligation; 2) Design for social rank; 3) Flexibility with sanctions; 4) Structured illiquidity; 5) Change the iconography; 6) Design with local values; 7) Design for convertibility; 8) Help calculate convertibility, 9) Design for relative volume, not increment; 10) Lucky Numbers, Tranches and Tiers; 11) Design for Cyclical Events.

New Organizational Models: Open-Source Financial Services Research (2010)

By Melissa Cliver

This is a catalog and overview of selected works from researchers funded by the Institute for Money Technology and Financial Inclusion from 2008-2010, showcasing international research investigating how individuals who earn only dollars per day store, share, spend, save and manage money. Particular emphasis is placed on design principles for new financial services.