| Visit https://www.imtfi.uci.edu/files/newsletters/2018_winter.html to view in your browser. |

|

Publications Collaborations & Public Engagements Blog |

Bill Maurer, Director |

Mind your Ps and 2s It’s hard to believe that it has been a decade since

IMTFI was founded. Back in the early days, the jury was out on

whether M-Pesa's apparent take-off in Kenya would be sustained;

whether other, prior mobile phone-based money transfer services

would endure in places like the Philippines and South Africa; and

what technological models, interfaces, and protocols would

ultimately win the day. We didn't even know what to call the phenomenon that we were witnessing: for a while, everyone attached the initial "m-" to everything, signifying "mobile," like folks had done during the dot-com boom with the prefix e-. So we talked about m-banking and m-savings alongside e-commerce. It's hard to remember what a revelation it was to make a key terminological change - and then to make a corresponding pivot away from the simple initial focus on loan repayment and banking services. The terminological change was to adopt the phrase "mobile money" to refer to all of the emerging mobile-based services that could perform any of the functions of banking, payment, credit, or commerce (largely inspired by the GSMA). The pivot was to realize that what we were witnessing was the creation of a set of new digital payment infrastructures, as Jake Kendall, Philip Machoka, Clara Veniard, and I argued in Innovations. Spotlighting payment and platforms rather than a specific service or functionality opened the door to thinking more broadly about the importance of infrastructures in general - technological as well as social - and their role in supporting the public good and in creating new profit opportunities for large-scale corporations and micro-scale entrepreneurs alike.

Bill Maurer, Director |

|

|

|

Mobile Money: The First Decade Working Paper By Stephen C. Rea and Taylor C. Nelms. The working paper surveys lessons from the first decade of mobile money research focusing on the studies produced by IMTFI Fellows. Rea and Nelms describe MM's primary use case of P2P transfer and then outline 10 insights gleaned from the research archive. |

MONEY AT THE MARGINS: Global Perspectives on Technology, Financial Inclusion and Design Edited by Bill Maurer, Smoki Musaraj, and Ivan Small. IMTFI is pleased to announce this forthcoming publication with Berghahn Books bringing together research by IMTFI fellows and postdoctoral scholars with commentary from leading experts. The book is Volume 6 in the Human Economy Series, edited by Keith Hart and John Sharp. |

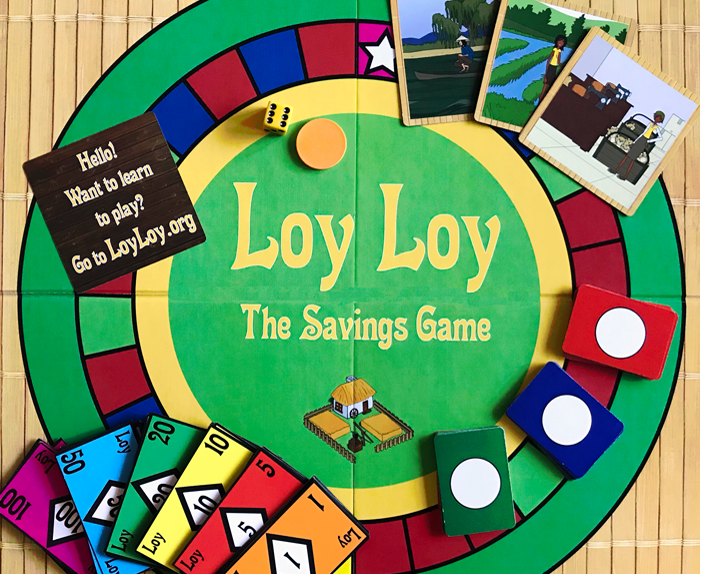

Loy Loy at the AAAs in the Loy Loy is an innovative role-playing board game that teaches financial literacy in an immersive group environment. It is designed to give players the experience of one type of rotating savings and credit association (ROSCA) that exists in Cambodia. |

|

|

|

|

|

Oh Shoot! What Now? Technology in a Time of Crisis |

|

|

|

featured: |

|

Keeping Cash: Assessing the Arguments about Cash and Crime Ursula Dalinghaus |

Intermediaries, Cash Economies, and Technological Change in Myanmar and India (Part Three) - An Illustrated Report Elisa Oreglia and Janaki Srinivasan |

Designing Financial Literacy Erin B. Taylor and Heather A. Horst |

|

|

|

|

|

|

|

|

|

|

|

A Bank Heist in Paraguay's 'Wild, Wild West' Reveals the Dark Underbelly of Free Trade

Caroline Schuster |

On Cash and Stuff

Bill Maurer and Lana Swartz

|

Curating the New (and Old) Stuff of Money

Bill Maurer and Lana Swartz |

|

How to Talk about Money: Ethnographic Approaches to Financial Life

Erin B. Taylor |

How India's Cash Chaos Is Screwing Over Their Neighbors - Oops!

Vivian Dzokoto

|

From the Wallet to the Refrigerator: Why in the Future Machines Will Pay for Everything

Andrés Krom |

|

How Nigerian ATM fraud victims are swindled

Oludayo Tade |

Beyond 'Send Money Home': The Complex Gender Dynamics Behind Mobile Money Usage

Susan Johnson |

Book interview with Bill Maurer on PAID: Tales of Dongles, Checks, and Other Money Stuff

Chuck Jaffe |

|

|

|

featured: "Using Blockchain to Secure the Supply Chain: Distributed Ledgers and Logistics for Critical Goods" IMTFI and Cybersecurity Policy & Research Institute (CPRI) co-organized a conference at UCI on November 14th where an expert group of industry leaders, academic researchers, and government actors explored the innovative potential of the blockchain to transform supply chain security. Keynote speakers included Tracy Frost (Department of Defense) and Paul Chang (IBM). Click for program and video presentations. |

|

|

IMTFI's International Board members and affiliated researchers assess the financial inclusion agenda in international development, identifying key areas of concern that remain unresolved: |

|

Can Financial Inclusion

Cornell University |

Reflections on the "Financial Inclusion of the Poor," Workshop in Karachi (Part One): Decolonizing Financial Inclusion

Habib University - Karachi, Pakistan |

Reflections on the "Financial Inclusion of the Poor," Workshop in Karachi (Part Two): Decolonizing Financial Inclusion

Habib University - Karachi, Pakistan |

|

Drama in the Payments Infrastructure and Saturation in Financial Education: Discussing New Avenues of Research Around Financial Inclusion in Colombia

ICESI University - Cali, Colombia |

Continuing the Conversations about "Financial Inclusions" in Latin America - onto Mexico

Ciesas Occidente - Guadalajara, Mexico |

Video on Remittances, E-Money, and Mobile Banking: The Migratory Corridor between Burkina Faso and Ivory Coast

Abidjan, Côte d'Ivoire |

|

|